Arctic paper in 30s: is a Polish-Swedish company in a paper business, it produces high quality graphic paper aimed at calendars, commercial leaflets and other promotional material. Arctic has also shares in company Rottneros which produces pulp, serving for paper production. This mix gives a good hedging; when pulp prices are down they simply earn less on the pulp and more on the paper, this producing stable EBIDTA through the year. It seems to be like predictable business but in their 4P horizon company aims to shift more from the graphical paper production to package paper and renewable energy production for this reason we are interested in this company.

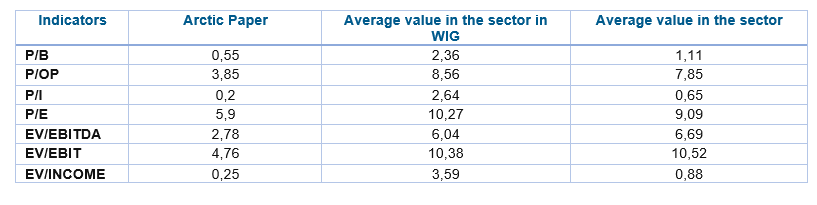

Arctic Paper is Polish-Swedish company in the paper business, it produces high quality graphic paper aimed at calendars, commercial leaflets and other promotional material. Since 2009 company is listed on Polish Stock Exchange. Arctic Paper has also shares in company Rottneros which produces pulp NBSK material used for paper production (however Arctic Paper uses other type of pulp which is BHKP).

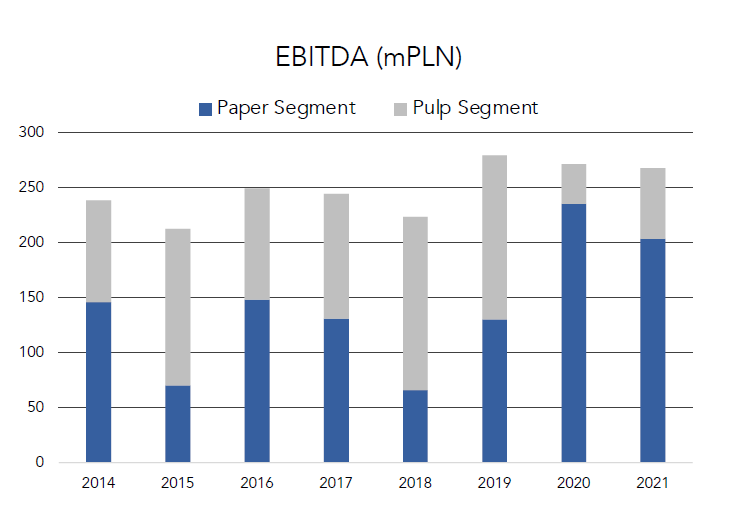

This mix gives a good hedging; when pulp prices are down they simply earn less on the pulp and more on the paper, this producing stable EBITDA through the years as shown below. However this situation is not always perfect like in 2018 when increase of the paper did not catch up for the pulp increase. It should be mentioned that pulp BHKP represents 50-60% of the company paper production cost. Every drop of 10 usd represents additional 10 millions margins. It seems to be like predictable business but in their 4P horizon company aims to shift more from the graphical paper production to cover paper and renewable energy production for this reason we are interested in this company. But let’s start from describing current company situation and how Arctic Paper survived COVID.

Current Cyclical business

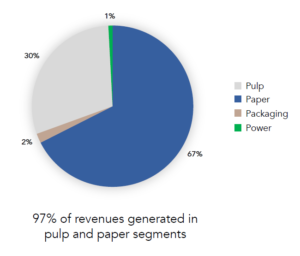

Paper is produced in three factories, one in Poland and two in Sweden. We have one factory in Kostrzyn and two factories in Munkedal and Grycksbo. The pulp factory are based in Rottneros and in Valvik. Company could produce 700 thousands ton of high quality paper per year while the pulp of 400 thousands ton per year. In recent year the income was mostly generated by paper part 70 % while the pulp part was responsible for about 30% of the income (see above figure).

The main clients of paper are Europeans countries while the biggest export is done to Germany, selling to Poland accounts for the 12%. The recipient of the paper are mainly high quality printed services and commercial agencies. While the biggest client does not account more than 10%. The pulp produced is mainly used for packaging and hygienics. Company was able to generate stable EBIDTA through the years. (sse above figure)

Situation during Covid

It is always interesting to see how such a company survives COVID. The year 2020 was very bad year for the company in terms of production capacity, the production was at 70% in Q2 (while in 2019 production was at average 95%). The work was done with reduced hours and Arctic Paper asked for help from the government. In Q3 production capacity was at 83% , and in Q3 it reached 85%. It has to be mentioned that even this drawbacks the situation was advantages for the company: spread between NBSK-BHKP pulp was about 200usd very advantages for arctic (NBSK cost more and company produce this pulp, BHKP cost less which company uses) , for this reason income was comparable to those of 2019 due to good prices and internal cost strategy. Even at volume level situation is worse then in 2019 however company was able to make up it by managing the costs and prices of paper.

Situation at beginning 2022

After COVID company regain it pace, in Q1 overall production increase to 94% reaching even 99% in Q3 2021. In 2021 company also increase the price of paper due to the increase prices of material (NBSK). The market did not oppose this increase since competition is closing their factories and shipments from China is expensive this naturally shift the prices up according to the CEO. Another factor contributing for the price increase is that paper companies are shifting more to package paper production. What is interesting is that Arctic Paper increase its package paper production of 150% y/y in 2021. This shift was inspired by EU law introduced since July 2021 “single us of plastic”, where plastic produced will be more taxed. This is a part of 4P company strategy detailed in next part.

If we go back to price of paper, paper increased 33% y/y (according to German statistical office) and in 1Q22 it could increase of another 20 % reaching evene 1000 eur/t; Recently the demand on paper is good, company has already risen price four times on average 100 eur/t, company has risen the price of the paper more than 20% y/y as stipulated during the last results press conference by CEO. The price of pulp are stabilizing however CEO does not expect such a decrease as in 2020. In future the material cost should lower since new pulp factory are opened in south America which could produce additional 8 mln ton of pulp, while the consumption is 1.5mln, this could lead to price decrease of 30%. Here we are speaking about the BHKP price. So in summary the situation of the company is stable.

Cover paper: 4P strategy

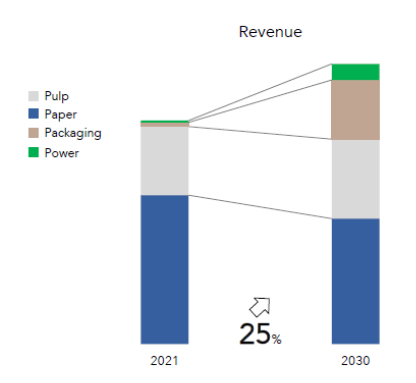

In July 2021 the EU law come to life “single use of plastic”, EU is shifting to be CO2 neutral, and the energy prices are quickly raising (representing 10 % of Artic Paper cost). For these reason company introduced the new strategy for years 2022-2030; where Arctic Paper focus more on cover paper (representing 2% of production today) and renewable energy sources (representing less than 2% of production today).

But let’s start from the beginning, and see how the situation looks right now for Arctic Paper in beginning 2022. Today Artic Paper produces mostly paper (67% of revenue) and pulp (30 % of revenues generated). Company is fifth producer of graphical paper in Europe and first producer of premium books and design paper also in Europe. Company generates stable EBITDA of 270 mlp PLN although cycles (price/pulp decrease/increase). However, as company is declaring, there is a decreasing market for graphical paper due to digitalization and we observe ecommerce boost the demand for package paper since we see shift from plastic to fibre based package. For this reason instead of being depended only at 2 pillar (paper and pulp). The new company strategy 4p focus right on 4 pillars : Power, Packaging, Paper and Pulp.

Power

At level of energy, today energy represent 10% of the total cost (however it generates some revenues below 2%) and free CO2 certificate will disappear after 2025 for this reason Artic Paper want to focus more on renewable energy source. The company plans till 2030 is to generates about 100MW from renewable energy resources. This in 2030 should generate about 7% of the income.Tha plans are pretty ambitious because so far in Kostrzyn the farm of 0.7MW has been built, and from 2023 they want to produce 17MW. In Poland they plan to produce 40MW from sun and the 60 MW from wind so in total five times more. In Sweden water energy is producing 6MW and should produce 8MW in 2030. Company wants to be CO2 neutral till 2035, rotternos want to be in 2030.

It has to be mentioned that so far in Swedish factory in Munkedal a water plant is build producing 6 MW and heat energy will be also produce by biomass with the 15 years contract signed. In Poland thanks to own cogeneration and local 20 year contract with yearly indexation we have stable energy prices.

Package paper

So far package paper represent only 2% of group revenues till 2030 company aimes that package paper will represent 18%. Package paper production should be 120k ton in 2030 and income should 800 mln. The european market of flexible should be growing at 8 % in 2020-2029. For package paper the delivery of equipment is 18 months so after this time we should see visible effects. So far Arctic Paper increase its cover paper production of 152% y/y in 2021. We should observe the first significant results from this already in 2023.

Paper

In 2022 paper represents 67% of total revenues in 2025 company want to decrease it participation till 57% and in 2030 to 46%. This is dictated by the decrease demand for the graphical paper, which decline 1%-3% annually. However company stipulate that market of high quality book paper and design specials segments are stable.

In summary in 2030 company plan to produce 580k ton of paper and 120k ton of package paper; Margins at cover paper should be 15 percent while at flexible paper 14-18 percent

Pulp

CAGR pulp market growth is expected to be at 4% and pulp market has a high entry barrier. Additionally pulp serves as the hedge against paper price decrease. For these reasons company aims to keep of around 30% level share in group revenue, while aiming 3% annual growth.

Disadvantage

- To much dependence on paper and pulp prices

- So far this is a cyclical business

Advantage

- New company strategy which focuses more on package and renewable energy source

- Stable business with high level of entry especially for pulp production

- Company delivers stable results over the years.

Arctic Paper: main company information

Market Cap: 637 mln PLN(12-02-2021)

Share Price: 9.2 PLN (12-02-2021)

Business area: producer of paper, package paper and pulp