Vigo System in 30s: Vigo System operates in promising market of photonics. It’s infrared detectors have wide range of application starting from medicine and ending at army. With newly introduced segment of semiconductors company is ready to enters the market of lidar, electronic wearable and 3D face recognition. Company has know-how which is hard to copy in this promising market. Vigo System is an interesting match for a long term investing.

Vigo System

Vigo System exists since 1987 and was founded by prof Jozef Piotrowski while ideas for a business reaches years seventies when concept of the non cooled middle infrared (MIDIR) detectors appeared. This is real high tech polish company which offers solutions in the area of detectors using MIDIR. Company products has application in industry medicine industry, transport and army.

In industry detectors are used for gas analysis, laser calibration, measurements of width l-paint.

In medicine detectors serves for blood analysis, oxygenation and glucoses levels (most of them are in the test phase). In Transport detectors are used for contactless temperature measurement of high speed moving objects. And finally in army detectors are used for measuring of temperature change on the vehicle for example due to laser pointing.

What is also interesting that Vigo System detectors was on Curiosity shuttle which was sent to Mars, with Vigo System detectors we were able to detect methane on Mars.

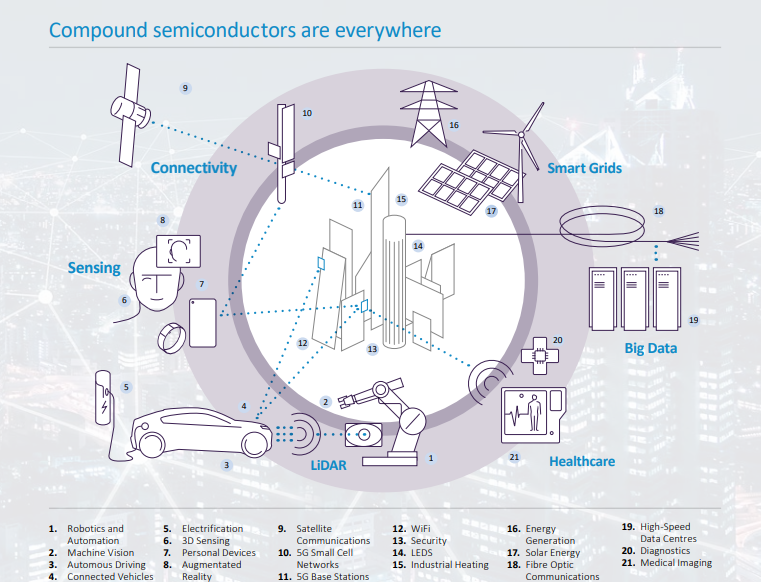

Vigo System produce mainly detectores but recently with dr Strupinski, epitaxial layer from GaAs INp are produced, where the application are broader here we have semiconductors materials. For this purpose the new manufacture, had been build, the first production has already started. Company focuses on the repeatability and standardization of production. Materials for photonics should generates income of 40mln pln at the 5 years lifespan. Here we have Nvidia and Toshiba as clients. Application are quantum cryptography, wireless communication and lidar.

Vigo System market and it's competitors

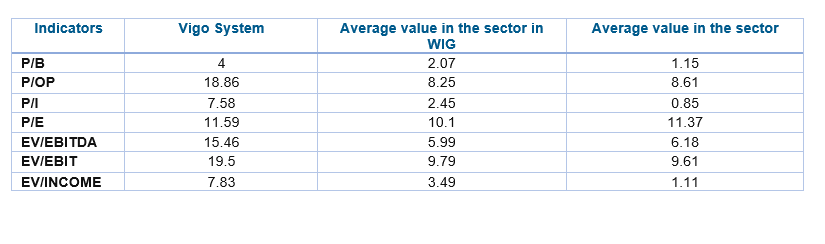

Vigo System operates in global photonics market, this market has CAGR of 7%. EU declared photonics to be 5 key top technologies for industry. When we go to the sub domain of photonic market we have infrared market where Vigo System operates. Global market of infrared has CAGR of 17% in 2018-22 according to Yole development, and Vigo System has 30% of the market. The main application areas are in the day to day electronics, 3D scanning , face recognition, gas analysis, lidar, monitoring system and e-health. We can distinguish four main competitor of Vigo System, here we have: Hamamatsu Photonics (Japan) with about 20-30% of the market. Teledyne Judson MOCVD detectors, which has mainly USA governmental contracts it is 30% of total market and finally we have Infrared Associates specialising in production of cooled detectors with 10% of the market. In the semiconductor market where Vigo System has recently started, IQE is one of the largest company in this field. IQE expects market growth at 25-30% CAGR, thanks to 5G. According to Yolo Development, the number of patent for lidar, thanks to medicine and face recognition application, in 2010-2017 CAGR was 45%.

Let's have a closer look how Vigo System generates its income

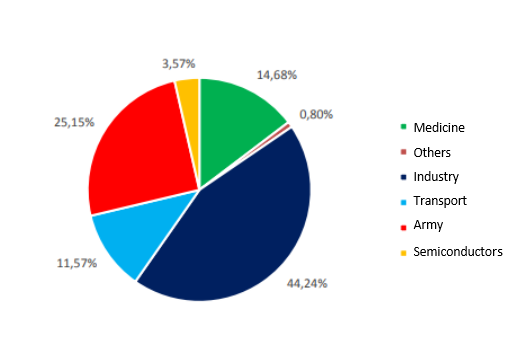

Over the last years main recipient of company products are: Caterpillar for transport application, Zodiac for army application and german company for industry application. For example in 2018 sales contributed 49% in 2019 55% and in 2020 48% from these 3 clients and distributors (7%-9%). However Vigo System is still looking for diversification. Company biggest sales contribution (year 2020) are from industry 44%, army 25%, medicine 15% and transport 11% and semiconductors recently started business accounts for 4%.

Company cost are at constant level since most cost are generated by personal, material and amortization. Also till 2026 company is at preferential tax. Additionally Vigo System wants to spend 10% of income at R&D, incubator of innovation. It has to be mentioned that the production cost is getting lower the cheapest detector is 100 euro (2020). Such a product was presented-on Photonic West. The price of such a detectors should be 100/200 usd above 500 per piece. Next step would be the possibility on mounting such a device on client electronic devices in assembly line. The board is estimating to produce 10K -20K detectors yearly till even 100K; In 2018 7.5k detectors were sold. It has to be mentioned that standard investments was below 100 pieces, since vigo system offers tailored products, here scaling might be difficult.

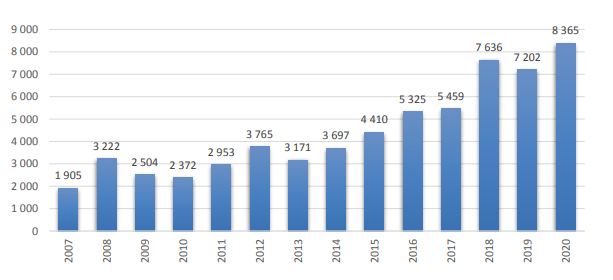

Another weak point is clean room which has capacity of 40k detectors yearly. By building the cleanroom and making it full operational, this will control every parameters as temperature or the air humidity this is a big step towards standardization. Today Vigo System produces two times more detectors then it was 3 years ago, this will be the record year since Vigo System introduced the cheap detectors. In the table below we see the detectors capacity production.

Vigo System closer look at Q3 2021 latest results

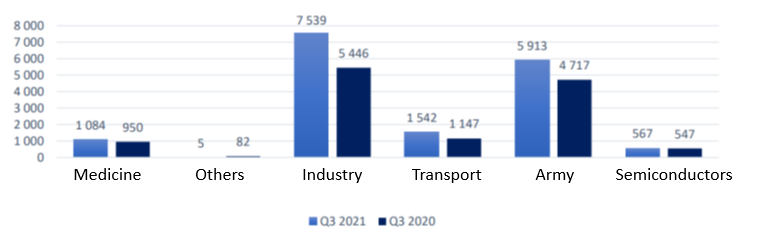

Q2021 results, Vigo

System reached 16,6 mln pln in sales which is 29% higher then in analogical

period year ago. Detector accounted for 16,08 mln pln while semiconductors for

0,57 mln pln. If we look at Vigo System segment we see that the highest

increase was in industry which is about 38%, transport 34,5% and army 25%. Vigo

System should start working in 2023 also on project for health monitoring.

Company also shared some expectation in future years

For industry: till now the income in this area grows at

20-30% yearly. According to Vigo System board this will be the main driver of

company here Vigo System expects on average 20% growth.

For army, the Safran contract is done company expect the

contract from PCO SA, according to board this segment should be above 20mln

pln, but in 2022 we should expect lower income from this segment.

Transport, here we have contract for Caterpillar, in 2022

company expect 10% increase in this segment

Semiconductor in 2022 it expect 2 mln pln income from this

segment

The materials cost are not so big part in Vigo System so the

supply chain issue is not a big problem, if the microcontroller is missing engineers try to be creative.

Vigo System strategy:

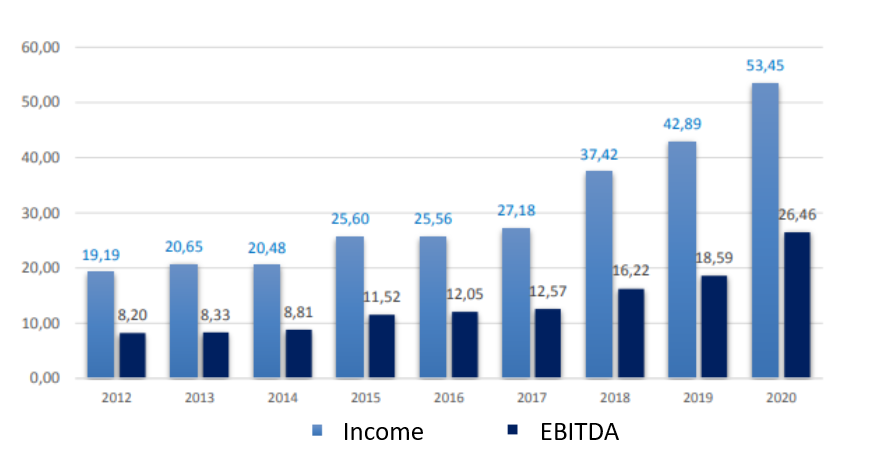

For year 2021-2026 company published a strategy.The income increase of 20-30%, gross margins at 60%, and EBITDA margins at 40%.Here the company share some prognosis

1) 67 mln pln

income i 29,5 mln pln EBITDA w 2021

2) 80 mln pln

income i 33,5 mln pln EBITDA w 2022

3) 100 mln pln

income i 40 mln pln EBITDA w 2023

As to attain these goals Vigo System will invest in 2021-2023 about 30-40 mln pln yearly. No dividends will be paid this year.

Vigo System acquisitions and ESG

In 2021 Vigo Ventures invested in Deep Detection start up, which is producing Xray multi spectral camera. This camera has application in food business as to verify the structure of the products. Previously Vigo system bought also KSM vision which takes care of optical quality control. These both companies could work with Vigo System detectors.

At beginning 2022 Vigo venture also invested in PhotonIP company working in the segment on integrated photonic. Vigo ventures representative hope that electronic chips will be replaced by photonic chips so the segment where PhotoIP operates. PhotoIP are in photonic business since nineties they offer solutions which are in motorization, telecommunication and wearables electronics.

Vigo is also active on ESG area, their detectors are used for gas analysis, analysis the quality of water used in petrochemical business (project AQUARIUS, 731465).) Vigo works on A(III)B(V) detectors which should replace the HgCdTe, which contains mercury. Company also works on detectors for narcotics

Pros

- Hig tech business with high barrier of entry

- Growing market of photonic and detectors

- Company is growing its production capacity

Cons

- 3 clients are responsible for 40% of income and one distributors 9%.

- Employees are hard to find.

- Company has a special tax allowance from the government which ends in 2026

Vigo System: main company information

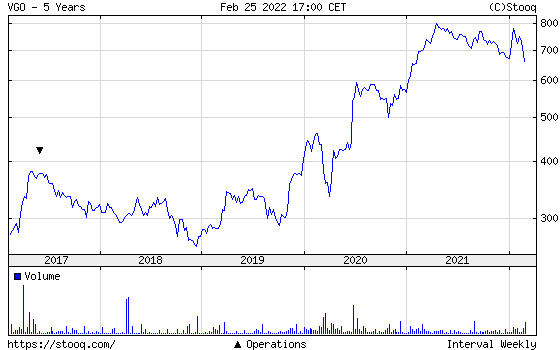

Market Cap: 481 mln PLN(25-02-2021)

Share Price: 660 PLN (25-02-2021)

Business area: photonics, detectors and semiconductors