As I wrote on the main page, Poland is not only cyclical, commodities stocks. Unfortunately big investors see the polish market as a “low-tech” economies. If we look at WIG20, polish index of 20 biggest companies we see its clear correlation with the commodity index (CRB Commodity Index (^CRY)).

Moreover, the CRB index historically rises in the environment of a weak dollar, so that emerging market currencies are usually in upward trends. In this case, where the currency of the country is in upward trend investors see the country as less risky (risk off strategy) and big investors are more keen to invest in emerging markets like Poland. We also have as strong correlation with the weak dollar.

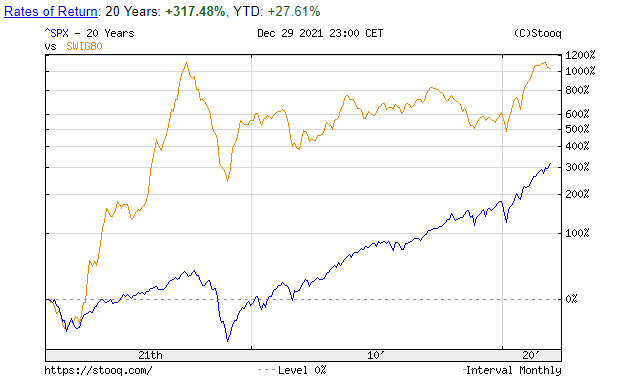

ETF for Poland underperforms SP500

Moreover if we buy etf for polish like iShares MSCI Poland.(EPOL) this etf in fact replicates the largest polish companies which largely underperform SP500 and it is simply mimicking Wig20. As we know Wig20 tends to be cyclical and on the 10 years it gives 20 % returns while SP500 gave 250% on the comparable period.

So how we invest in Polish company and have good return even beating SP500

Big investors due to liquidity can invest only large cap stock so in WIG20. In contrary to institutional investors we can invest in smaller companies. If we look at index of middle (40 medium companies mwig40) and small cap stock (80 small companies swig80) on see two things:

First we see that we are not so cyclical additionally we see it especially after 2008 of financial crisis.

Secondly we observe that the returns are pretty good. On mwig40 for 20 years we gained 500%, on swing 1100% in comparison to wig20 which is 100 %.

In addition I want to stipulate that individual investors has an advantage here. In swig80 companies are not so covered by analytics and investors after doing due diligence could profit from the ineffectiveness of the market. In contrast to large cap where informations spread faster because many well informed people observe this stock, here markets are more effective. For this reason we invest mostly in this companies, many analysis of the such companies you could find on this site.