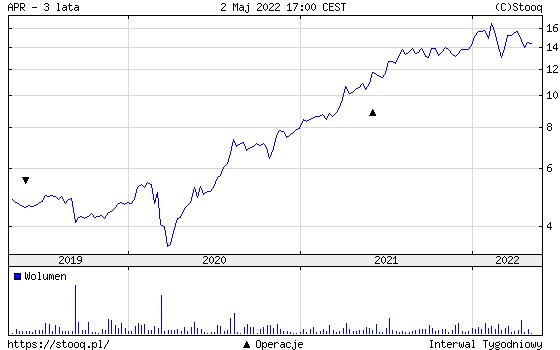

Auto Partner SA in 30s Auto Partner SA group is the distributor of parts for automobiles offering wide range of products starting from suspension and ending on electrical systems and engines. Company has grown it’s market share, in 2016 it represented 6% and now it is 10%, in Poland of course. Since number of used cars increases, we have many governmental subvention for families and market of used car is inflations resistant (you need to replace your broken engine if is not cheap) we find an Auto Partner SA an interesting company.

Constant growing business of Auto Partner SA

Auto Partner SA group is the distributor of parts for automobiles. The group is specialized in organisation of distribution of vehicle’s spare part from manufacture to the end user. Company also perform service for independent car repair shop and car part shops. Company offers affiliated shops a discounted prices, leasing of tools and know-how. Auto Partner SAis mostly distributing suspensions (16%), breaks(14%) drivetrains (12%), electrical systems (10%), engines (17%) and others parts which accounts for the rest of 30% services. In overall company is hiring more than 2k people in 2021, while the employment increased by 20% when compared to the year 2020.

Auto Partner SA is growing in polish market

In Poland Auto Partner SA is the third largest car parts distributor. Group has nearly 10% share in domestic market of spare parts. It has to be mentioned that market share doubled since 2016 when company debuted at Warsaw stock exchange, back then the estimated market share was at 6% which was fifth place in Poland.

Big storage capacity as to fight supply chain issue

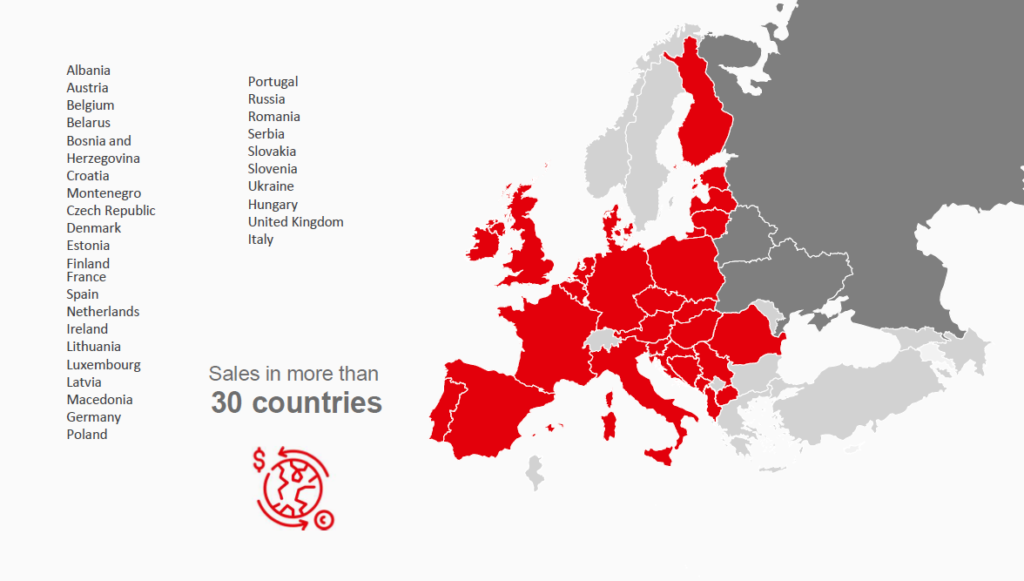

Company has its own distribution center in Bierun and warehouse in Pruszkow, they have also storage space in Prague. Auto Partner SA operates in Poland but the they also export to Czech Republic Slovakia, Germany and Hungary in fact group sells part in 30 countries in Europe. Export accounts for 45% operations of the group. Company have couples of months supply rotations, this in the time of increased prices could increase gross margins. The company turnover is on average 144 days.. Auto Partner SA has more 250,000 references parts available, 15.5m parts warehoused throughout Poland. Auto partner offers replacement parts of companies such as NK, ALCO, MaXgear, Quaro, RYMEC, Unior, ROOKS. Company is enlarging its offer also for motorcycles and motor scooter.

Client and competition

Main company clients are independent workshop and car part shops. In Poland independent workshop are accounting for 70%, while 30% are the affiliated service workshop. Auto Partner SA has 106 branches (shops) . It is important to mention that export to Ukraine and Russia was 0.1% and 0.5%.

Group see also the competition from the authorized services for customers with warranty vehicles, especially the ones which goes up to 8 years. Clients are offered the lower price which may force local distributors to cut their margins. Currency risk, company is not hedging against currency risk. However Auto Partner SA purchase and sales in others currencies because of that this risk is partially mitigated. In 2021 53% purchase and operating expenses were denominated in the foreign currency like eur usd, while foreign currency sales accounted for 47%, this mainly done in pln eur.

Overall market and sitution in Poland

On polish market company has many headwinds like: governmental subvention for the family called 500+, we also have a growth of passenger car registration and average passenger car We can also state that number of cars per person is increasing. It is worth mentioning that Polish people spend twice less for fixing cars as other European which is 500euro with respect to 860euro in other European country. If we look at the market in overall we also have couples of positive tendencies. Market growth is 4.3% on new passenger car registration according to ACEA . We have also average age of imported passenger car which is over 12.6 years (according to IBRM Samar).

In Europe we have 569 cars per 1k habitants, decline of 2.4% in new passenger car registration Average age of passenger cars is 11.8 years (according to ACEA). We observe also growing prices of pre-owned cars up by nearly 20% over the past year (according to AutoScout24). The car part market (without tyres) is 9.3mld, this market has CAGR of 6%.

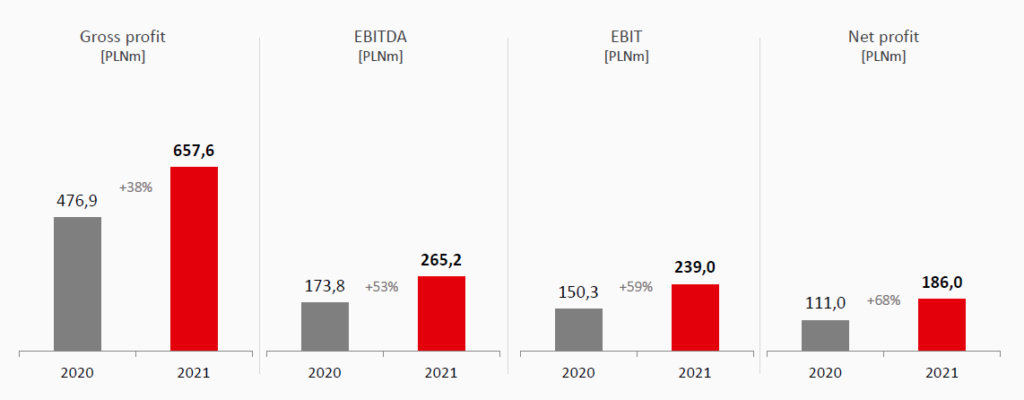

Focus on latest results of 2021

In the recent quarters company had very good profit dynamics even bigger then income dynamics. We also observe higher increase of sales to EU counters +40% then in Poland +23.5% compared on the yearly basis, at the moment sales in Poland represent 55% of the total sale. In April company increased prices mostly due to high euro/pln, in this case we expect better margins since stock rotations is 132 days, so the parts were bought at the lower prices could be sold at higher prices, and in history company was able to put the cost increase on its clients; Inflation is a challenge for car producers but not for spare parts manufacturers. Since customer have no other alternative.

In 2021 they had record sales, high foreign expansion increase, gross margin at 29.1% and expansion of distribution network, 14 new branches opened. They have also increase the stockage parts

It is worth mentioning that company already has distribution centre in Bieruń , Warehouse in Pruszków , Warehouse in Prague some local storage facilities within the branch network and company plans to set up a warehouse in Poznań. Domestic and export sales are handled from the central warehouse in Bieruń and the Pruszków hub. They open new stockage place in H2 in Poznan this could influence their margins. 50% of stockage is held in the main Total warehousing space at the Group (held under leases) – over 100,000 sq m. Cash flow is negative since company increase its scale which requires increase the capital, which is increase of storage

The company is constantly increasing it storage capacities in Bierune and Pruszkow, as mentioned right now company is in the process of opening logistics and storage are in Poznan. The Group currently supplies customers in Germany, Austria, the Czech Republic, Slovakia, Hungary, Romania, Slovenia, Croatia, Serbia, Bosnia and Herzegovina, Lithuania, Latvia, Estonia, the Netherlands, Belgium, Luxemburg, Denmark, Finland, France and Italy.

So in summary they obtained: +35.4% y/y increase in revenue, strong growth in export sales, +46% y/y (topping PLN 1bn), growing contribution of exports to total revenue, robust sales in Poland: +27% y/y.

Company opened also more than a dozen new branches in Poland and launch of new export directions and routes. Company is also dealing with rapidly changing pandemic situation and its impact on the spare parts distribution market in Poland and other EU countries. At the financials& level: They have low debt and maintained solid profitability. Auto Partner SA maintained cost discipline, it maintains rather a low net debt to ebitda ratio of 1.2, this fact is important in the environment of high interest rate. Auto Partner SA has its concordance advantage thanks to process automation and IT.

Main disadvantage,

- Cars will be more and more hig-tech and the independent car shops will not be able to repair it , however there UE claims to introduce some rules for know-how access

- Consolidations of small shops, entrance of the foreign shops.

- Currency and supply chain risk

Main advantages

- Numbers of used cars is increasing

- Governmental subvention

- Stocks rotation of more than 100 which is influence positively margins during price increase

- Prices increase could be easily put on clients, the company has a track record of doing so

Auto Partner SA main company information

Market Cap: 250 mln PLN(23-01-2021)

Share Price: 16.3 PLN (23-01-2021)

Business area: electromechanical RES