Brand 24 growing polish SaaS company

Brand24 in 30s Brand24 is Polish SaaS company that offers analysis of marketing strategy evaluation by monitoring clients commercial content on social media, blogs or information services. Brand 24 also helps to protect companies image thanks to quick access to discussion group, analysis of marketing, tracking competition, observing client relation and finally by engagement with clients on the internet forum. Even thought this a growing company taking up more and more market they are profitable. We also see that key numbers like ARPU and MRR are constantly growing from year to year and even quarter to quarter. For these reason we find this company interesting.

Brand 24 is a platform that performs analysis of marketing strategy and perception of clients brand by monitoring its commercial content on social media, blogs or information services. Company monitors the key words at many platforms, track personalized discussion, perform interaction with client, find influencers and perform trend analysis. Brand 24 also helps to protect companies image thanks to quick access to discussion group, analysis of marketing, tracking competition, observing client relation and finally by engagement with clients on the internet forum.

Brand 24 was created in 2011, in 2014 they went global. The main client of the group are small companies hiring till 50 persons, however among company clients are also big players like Intel, Carlsberg, IKEA, OLX, H&M, Vichy, GlaxoSmithKleine and Credit Agricole.

Brand24 works on subscription model more than 80% of clients pays at monthly basis, clients are in 154 countries and no client represents more than 10% of Brand 24 income. In 2021 the amount of international clients reached 69%. More than 50% of accounts are created through direct access to Brand24 site.

More than 99% of income is generated from subscription the additional percent is generated through personalized subscription.

Even thought this a growing company taking up more and more market they are profitable. We also see that key numbers like ARPU and MRR are constantly growing from year to year. For these reason we find this company interesting.

Financial and key parameters

Brand 24 generates income which is constantly growing, in 2021 was 15.8 mln pln which is 2.4 mln pln increase compared to the previous years. The income of the Brand24 is up 26% yearly ad 10% quarterly. It should be mentioned that In motivational program they assume big 30% yearly income increase

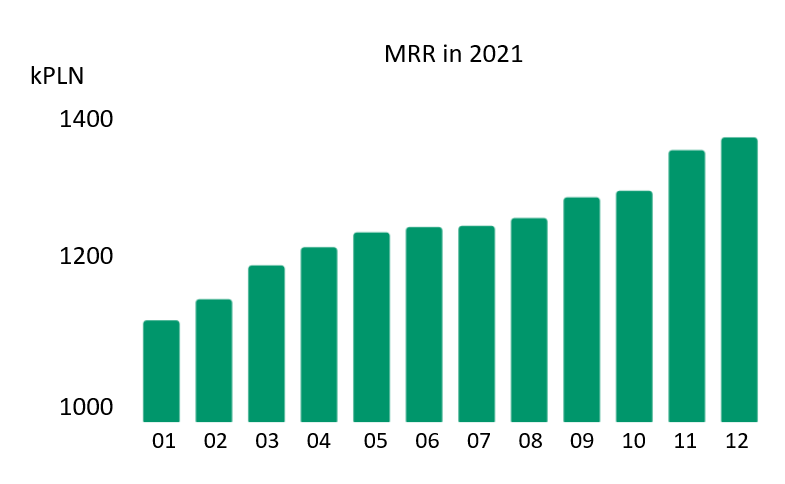

Also when we look at key numbers which are representative for SaS company here we also observe growing tendencies. ARPU and MRR are growing on the monthly basis. Before discussing the main key numbers we should mention that company recently change their offers, this change has 3 pillars. First they made revision of the discount for the current clients in Q421, secondly since november 2021 Brand 24 increased the price for new clients and thirdly since january 2022 they will increase prices for existing clients and changed the tariffs.

For this reason ARPU is increased 4% in the last months of 2021, it has to be mentioned that for new clients ARPU increased by 40%. Brand24 has also more and more clients from abroad here we have better ARPU since abroad clients tend to choose bigger tariff. Every 10% increase is the 0.37mln PLN profit additionally.

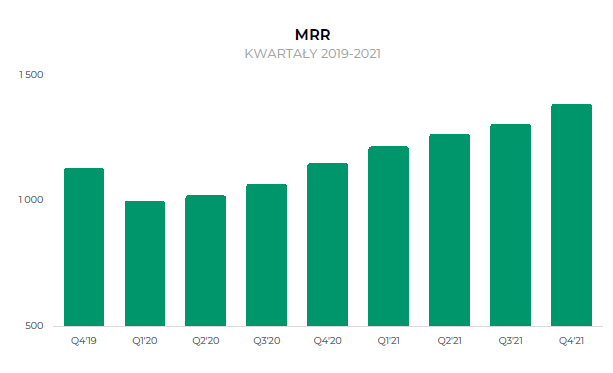

MRR , If we take a closer look at 4Q we see that MRR rose 6%. This was done mainly to the tariffs changed mentioned above.

For existing 321 clients the discount was changed, where 72 client resigned. Total number of clients was 3905 at the end of a year. The aim is increase of ARPU and MRR but the drawdown is the client resignation. Client is with company on average 20 months, it leaves 2k usd, the acquisition cost is about 300usd. However we obserce number of clients are constantly growing on the yearly and quarterly basis (expect for 2019 see chapter below)

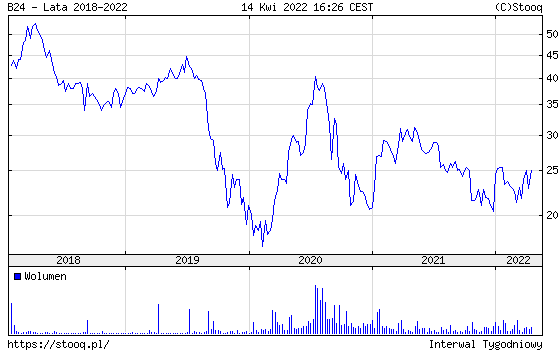

Focus on the Facebook ban

In 2019 company was blocked by Facebook as they were connected with Cambridge analytics affaire. Even though the Facebook is the small contribution of the Brand 24 income, it created client dynamics drops, from 3600 clients in Q3 2019 till 3000 clients in Q1 2020. We see this influence on MRR where the recurring revenues dropped in Q1 2021. According to company this ban was injustice since Brand24 does not collect sensitive data. As to lower the consequence of client dynamic decrease due to Facebook ban Brands 24 increased marketing spendings for example in the payable traffic, in this situation we observed the increase of payable traffic while the increase of customer were not significant. We also see this negative influence on the stock price. The situations seems to be better after 2021, when facebook ban we not in power. In may 2021 they have significant increase of client. the whole 2021 we have significant client increase.

Strategy

Company aims to acquire 150-300 new customers quarterly mostly on foreign market. The pages of Brand24 are visited by 100k visitors on monthly basis. For this reason additional feature was introduced: customer reports. Custom reports offer the market analysis and semiautomatic report prepared by Brand 24 analytics they are based on varying profits, mostly the analytics job is paid by hour. The gross margins are 80%, company want to have 10 clients till end of the 2021 till end 2022 40 clients which translate into 1.5 mln PLN additional income yearly. Brand is working constantly on the tools like: presence score, trending links, user generated content.

Also in 2021 company started moving away from division between local and global site. In polish version company has four subscription tariffs in global three. Right now Brand24 is working on standardization so will be no version difference between Poland and abroad. Polish version of the program is different since we have the data till 8 years in abroad version only couples of months. This is caused that polish internet is smaller, and the data collection for Poland is bigger. The abroad version is more expensive since are much more data to filter. The unification process should be done in 2 year horizon.

Company is also working on AI tool. It is worth to mention in 2021 Brand24 received a Grant 3.8mln PLN for building the advanced technology of text recognition

Saas market

According to Gardner the cloud service grows from 200mld usd in 2018 till 400mld usd in 2022. SaaS market change according to Gartner is not linear. The SaaS segment should grow 20% yearly according to Gartner. The market of monitoring data was in 2020 was estimated at 10mld usd with CAGR 36%.

The companies competition in Poland are Mention Solutions SAS and Awario. With respect to competition Brand24 offers actualization of monitoring results with every minute frequency, better range of monitoring which includes brand portals, blogs, forum ,newsletters podcast they offers also lower price. The price is lower of 10% compared to Awario and 50% lower when compared to Mention Solutions. When compared with international leader we have google alerts.