Why investing in Poland

Poland is located in Central Europe with population of 38.5 million people, and we are the fifth-most populous member of the European Union. Warsaw is the capital of Poland [1]. In terms of GDP, Poland is the sixth economy in the European Union and the 25th economy in the world (in 2016) [2]. According to the OECD, the pace of growth of GDP per capita in Poland in the years 1992–2002 was one of the highest in the world and went to 116% [3] . According to Human Developed index (HDI) (Poland has index of 0.821) Poland classifies at 39th place in the world out of 187 included countries [4]. This place according United Nations puts Poland among Highly developed countries. The level of unemployment in Poland in 6.5 at 2020 [5]. After joining European Union in 2004 and thanks to single market the Polish export increased three time and import increased more than two times also we observed two fold in increase of foreign direct investment [6].

Polish stock exchange

Polish Stock exchange (Warsaw Stock Exchange WSE) has capitalization of 281 000 millions euro with 430 company listed [7]. In this shape Polish stock exchange was established 30 years ago on 16/04/1991. On the first day there were traded only 5 stocks with turnover of 2 thousands euros. The WSE is member of Federation of European Securities Exchanges and United Nations Sustainable Stock Exchanges (SSE) initiative [8]. In 2008 WSE was recognised “Advanced Emerging” by FTSE. On 2017 FTSE polish stock market has been upgrade to Developed market status [9]. In Warsaw Stock exchange we can trade: shares, bonds, subscription rights, allotments, and derivatives such as futures, options, and index participation units. The pre market session is from 08:00am to 09:00am, trading session IS from to 09:00am till 4to 04:50am and post-market sessions IS from 04:50pm to 05:00pm five days a week.

ETF for polish market

As to have exposure on Polis stock market you can buy following ETF, please read this part where we tell why we do not invest in Polish ETF :

- iShares MSCI Poland ETF with 85 percent exposition in Poland however here we have only large cap polish, state own companies like PKO or KGHM, which normally under- perform SP500. This ETF since 2010 gained almost 20% while SP500 250%.

- Freedom 100 Emerging Markets ETF with 15% polish exposure, since inception 06/2019 it rose about 25% while SP500 50%.

- Cambria Global Value ETF (GVAL) since launching date this ETF is couples percent down, here we have 8 % Polish exposure.

- We also have another ETF for polish with 5 % or less exposure the list is here

Investing in particular Polish companies, investing from European Union

Investing in all Polish companies could be done via broker in EU and United kingdom, I use degiro

Degiro is available in France, Germany, Italy, Spain, United Kingdom,Norway, Poland, Netherland Hungary, Greece,switzerland, Austria, Portugal Sweden, Denmark Ireland, Finland and Czech Republic

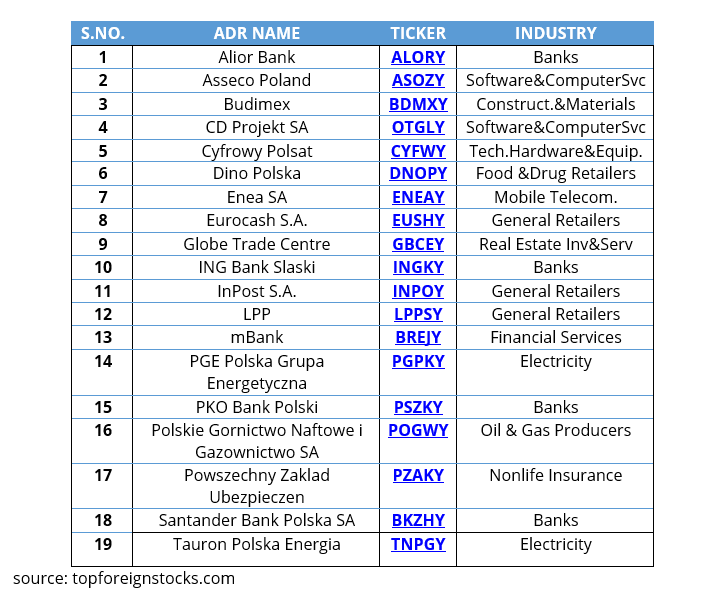

Investing in polish companies from outside European unions.

Outside European union polish stock could be traded via Polish ADR which are listed on the OTC, this ADR have exposure to Polish biggest companies mostly government owned and banks from WIG20, for WIG20 performance please read this. You can find the whole list here

Polish history in bullet points

966 – Christianisation of Poland

1025 – Poland becomes Kingdom

1795 – Partition of Poland, Poland cease for 120 years

1918 – Reconstitution of Poland

1939 – Invasion of Poland, World War II starts

1945 – Poland becomes communist country under USSR supervision, the

1989 – End of communism

2004– Poland joining European Union.